Get Early-Stage VOIE Clarity Before You Spend Time (and Money) Chasing It

Mortgage teams don’t just need data. They need certainty early so they can route loans correctly, avoid unnecessary verification steps, and keep...

A FICO credit score is a statistical number calculated by credit information from the three credit bureaus: Equifax, Experian, and TransUnion. All three bureaus generate a separate credit score, each being slightly different due to data variances in the credit reports.

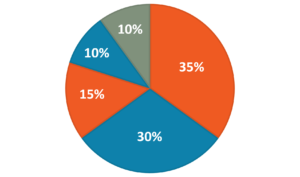

There are five main factors that make up your score with different levels of importance:

Payment History (35%): late payments, tax liens, bankruptcies, etc.

Accounts Owed (30%): outstanding balances on accounts

Length of Credit History (15%): the longer your history, the better

New Credit (10%): inquires/applications for new credit accounts

Credit Mix (10%): the mix of credit cards, retail accounts, loans, etc.

Mortgage lenders will take the median of the three FICO scores and use it to determine whether or not to give you a loan. If given, it'll also determine what the interest rates and fees for that loan will be. The higher your FICO score, the lower the fees and rates.

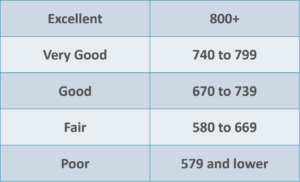

Your FICO score can range from 300 to 850 under the following categories:

There’s no quick way to fix poor credit, so be skeptical of “credit repair” companies that say otherwise. Also, the bureaus and other companies might also try to sell “credit monitoring” services for a monthly fee, but you can monitor your credit report yourself using a free copy from annualcreditreport.com or call 877-322-8228.

What Not to Do

DON'T:

Experian: 800-525-6285

TransUnion: 888-397-3742

Equifax: 800-680-7289

CFPB: consumerfinance.gov/learnmore

Privacy Right Clearinghouse: https://www.privacyrights.org/consumer-guides/your-credit-score-how-it-all-adds

FICO: myfico.com

The right partner makes all the difference. With IR, you gain smarter credit and verification solutions, a team that has your back, and a strategy that grows with you.

/Blogs/2026%20Blogs/02-26-TWN%20Indicator/IR_Blog--Income-Qualify-and-The-Work-Number-Report.png)

Mortgage teams don’t just need data. They need certainty early so they can route loans correctly, avoid unnecessary verification steps, and keep...

/Blogs/2026%20Blogs/01-FHFA-Vantange-FICO/IR_Blog-Credit-Score-Modernization%20(2).png)

As the mortgage industry navigates FHFA’s credit score modernization initiative, lenders are facing new questions around model choice, implementation...

As the mortgage industry navigates FHFA’s credit score modernization initiative, lenders are facing new questions around model choice, implementation...