Get Early-Stage VOIE Clarity Before You Spend Time (and Money) Chasing It

Mortgage teams don’t just need data. They need certainty early so they can route loans correctly, avoid unnecessary verification steps, and keep...

A Fair Isaac (FICO) credit score can be generated for anyone with at least one reported credit tradeline in the past 12 months and is based on data from the three credit bureaus: Equifax, Experian, and TransUnion. All three bureaus generate a separate credit score, each being slightly different due to data variances in the consumer profile.

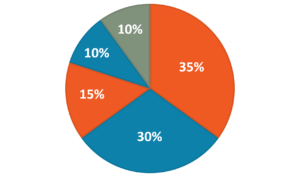

Payment History (35%): late payments, tax liens, bankruptcies, etc.

Accounts Owed (30%): outstanding balances on accounts

Length of Credit History (15%): the longer your history, the better

New Credit (10%): inquires/applications for new credit accounts

Credit Mix (10%): the mix of credit cards, retail accounts, loans, etc.

MYTH: Paying off credit cards, collection accounts, tax liens, etc. will always increase the FICO score

FACT: The FICO model score reflects updates from "Date of Last Activity," so paying off an old collection account can count against your borrower

MYTH: Closing accounts with zero balances will increase the FICO score

FACT: Closing accounts can raise the overall credit utilization, which can end up decreasing the FICO score

MYTH: Public records, judgments, liens, etc. negatively impact the FICO score forever

FACT: Most are removed from a credit file after 7 years (10 years in California)

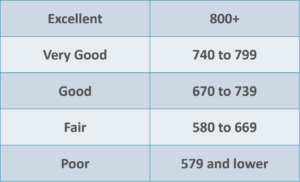

> FICO scores can range from 300 to 850 under the following categories:

>> Our CreditXpert Solutions Suite can improve your borrower's score by up to 50 points:

Credit Assure™

Automatically scans the credit report and shows you the increased score that your client could potentially achieve

Wayfinder™

Determines the best actions to take so you and your client know how to increase their credit score

What-if Simulator™

Before taking action, easily plug in custom or predefined scenarios to predict how the score would change

Positive

Paying bills on time

Low balances compared to maximum credit available

Positive credit management over the past 2 years

Negative

Delinquent payments and collections

Opening too many accounts in a short period of time

High total outstanding debt and derogatory public records

Lenders use credit scores to predict how likely a borrower is to repay a new debt based on past credit behavior. FICO scores are also used to determine the type of mortgage, costs, and interest rates.

There are no regulations that state a specific score must be displayed to the consumer, so different entities can choose which score they want to display from the multiple bureau options available to them. On the other hand, lenders are required to pull a specific score for mortgage lending so there’s consistency when making a lending decision.

There could be 3 main causes:

The right partner makes all the difference. With IR, you gain smarter credit and verification solutions, a team that has your back, and a strategy that grows with you.

/Blogs/2026%20Blogs/02-26-TWN%20Indicator/IR_Blog--Income-Qualify-and-The-Work-Number-Report.png)

Mortgage teams don’t just need data. They need certainty early so they can route loans correctly, avoid unnecessary verification steps, and keep...

/Blogs/2026%20Blogs/01-FHFA-Vantange-FICO/IR_Blog-Credit-Score-Modernization%20(2).png)

As the mortgage industry navigates FHFA’s credit score modernization initiative, lenders are facing new questions around model choice, implementation...

As the mortgage industry navigates FHFA’s credit score modernization initiative, lenders are facing new questions around model choice, implementation...

.jpg)