Get Early-Stage VOIE Clarity Before You Spend Time (and Money) Chasing It

Mortgage teams don’t just need data. They need certainty early so they can route loans correctly, avoid unnecessary verification steps, and keep...

Trended data is a powerful tool: just ask Fannie Mae, who has been using it to improve lending risk assessment. But you can use trended data to uncover the consumers who are almost ready to be your customers and start warming them up as leads.

Their credit score might tell you they can't afford to buy a home right now, and maybe you left them off the target list for now. But if you analyze the data the right way, you'll recognize their rating might be on the verge of a significant upturn, so it might be time to start building those relationships.

The stakes are high. Regardless of the industry trends for loan volumes, there is always enormous pressure to keep margins as high as possible, which means it's crucial to find and qualify the right potential borrowers quickly.

But don't forget the counter-risk: your process may disqualify potential borrowers too quickly. Some of those borrowers - the "almost-qualified" let's call them - might deserve some attention from your marketing team. In fact, you may have leads already within your system that were tossed out prematurely.

Trended data can help lenders determine whether consumers are getting better or worse at managing their credit — a critical distinction for identifying borrowers with a lower credit score who are making strides to becoming credit-worthy. By understanding where a borrower is in their credit journey, lenders can create specific campaigns to nurture and engage with borrowers at a time when they are feeling shut out of the lending process.

An industry best practice is to maintain relationships with buyers who are trending toward qualifying.

With the right tools, you can consider all the data variables to predict where you should be marketing in a cost-effective way. Better still, the same techniques can be used to discover the almost-qualified prospects that you may have overlooked. You may have set aside some prospects based on a very narrow set of data points that don't account for the complexity of a borrower's financial picture.

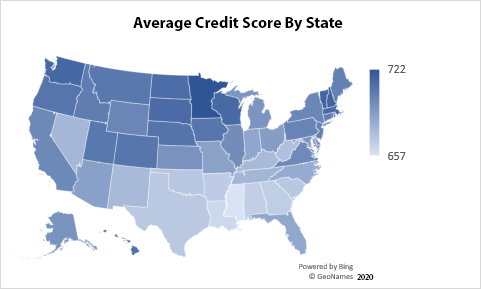

For example, since the financial crisis, borrowers in southern states like Mississippi, Alabama, Georgia, and Louisiana have had lower average credit scores than borrowers in the Midwest and some northern states. You can see the visual representation on this map here:

Does that mean lending to Southern-state borrowers is risker than lending to Midwest borrowers? Not necessarily.

"Consumers with good credit scores tend to get cards with higher initial limits, and larger limit increases. That allows them to have higher balances while also having higher scores," Credit expert John Ulzheimer explained in a CNBC article. "Consumers with poor credit scores tend to have lower limits, so even modest balances cause a higher utilization ratio and, thus, lower scores."

Need help using trended data to find prospects who are on the cusp of being qualified? Reach out now and we'd love to help you.

The right partner makes all the difference. With IR, you gain smarter credit and verification solutions, a team that has your back, and a strategy that grows with you.

/Blogs/2026%20Blogs/02-26-TWN%20Indicator/IR_Blog--Income-Qualify-and-The-Work-Number-Report.png)

Mortgage teams don’t just need data. They need certainty early so they can route loans correctly, avoid unnecessary verification steps, and keep...

/Blogs/2026%20Blogs/01-FHFA-Vantange-FICO/IR_Blog-Credit-Score-Modernization%20(2).png)

As the mortgage industry navigates FHFA’s credit score modernization initiative, lenders are facing new questions around model choice, implementation...

As the mortgage industry navigates FHFA’s credit score modernization initiative, lenders are facing new questions around model choice, implementation...