Get Early-Stage VOIE Clarity Before You Spend Time (and Money) Chasing It

Mortgage teams don’t just need data. They need certainty early so they can route loans correctly, avoid unnecessary verification steps, and keep...

Following the 2008 financial crisis, Congress enacted a host of new measures designed to ensure that the worst excesses of the 2000s were not repeated. One of the reforms, part of the Dodd-Frank Act, was the requirement that lenders had a new responsibility to make a reasonable and good faith effort to verify that borrowers had an “ability to repay” their mortgage. That included a prerequisite that lenders conduct, and document, verification of employment (VOE) and income (VOI), establishing a more acceptable level of risk for the institution, and ultimately, for investors and taxpayers

While the process of verifying a borrower’s employment and income would seem to be a simple process, what has evolved over the past decade has been an ever-increasingly complex web of third-party verifiers, whose technology is often layered on top of other mortgage tech platforms and systems. Instead of making the process simpler and easier, many lenders have found that adding one more layer (likely incompatible with their existing systems) to their tech stack duplicates work and may not save time or money. If the VOE/VOI product doesn’t align with your POS, LOS, CRM, and other systems, workflows break down, and the possibility of an error increases.

If you’re a lending executive, mortgage tech systems professional, or frustrated underwriter, the good news is that by utilizing our Verification Platform, you can significantly improve your process, improve turn times, and see tangible efficiency gains. Informative Research’s VOE/VOI Verification Platform provides lenders a one-click service to fulfill all verification of employment requirements for salaried applicants by custom-designing a fully integrated workflow process.

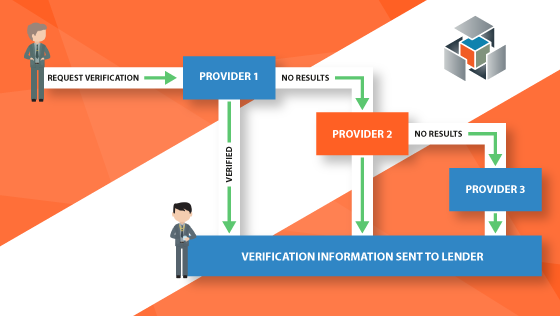

The IR Verification Platform is a service that provides clients with an option to create customizable waterfalls for automatically ordering verifications of employment and income. Lenders select from a list of connected verification partners to pre-configure the steps in their tailored system. Starting with the first step in the waterfall, the automation cycles through each verification provider, in the Lender's pre-selected order, until a consumer’s employment data is found. Instead of negotiating contracts with multiple providers and struggling to integrate disparate systems, IR’s Verification Waterfall utilizes cutting-edge API technology to allow the lender to engage with each of the connected verification providers.

Imagine borrower John Smith is ready to purchase his first home and has provided you with his pertinent employment information. Instead of running his information through The Work Number and hoping his employer provides data to Equifax, you enter his info in your custom Verification Waterfall dashboard. Since your company has chosen Experian Verify as a preferred service, the system checks there first. If John Smith’s information is not found there, the system automatically moves on (“waterfalls”) to the next provider you’ve designated during setup, and so on from there. Instead of a back-and-forth, cat-and-mouse game, trying to find the right provider, IR’s Verification Decisioning algorithm does that for you. And, because it utilizes API technology, it seamlessly integrates within your existing tech stack while communicating with your LOS engine, servicing platform, or any other processing system you have installed.

Additionally, our Verification Waterfall stays ahead of any tech/process changes that happen with any of the providing systems, keeping your team focused on what matters. And if you need to adjust your waterfall flow to better suit your changing needs, it’s a simple procedure that doesn’t require downtime— our Platform evolves with you.

Whether through our web portal, a direct API integration or enabled POS and LOS systems, ordering and retrieving verifications of employment and income is simple and easy.

/images/vendor%20logos/All-VPBlog-Logos.png?width=1110&height=195&name=All-VPBlog-Logos.png)

AccountChek

This allows your underwriting staff to focus their attention on the borrowers who need a manual verification or have another hurdle that requires further attention. This takes a significant technical, manual, and risk intense process off your hands as the lender, resulting in less work, higher success rates, lower cost, and improved cycle times.

Bottom line—verification of employment/income is a required, and now standard, part of the mortgage transaction. How you verify is a crucial decision that impacts your bottom line. You can pay staff to make phone calls to employers, document the verification, and spend valuable time tracking down data. You’ll face an increasing level of risk, due to human error and fraud, and watch your metrics (turn times, pull-through, etc.) suffer. Or you can utilize our Waterfall and decision engine custom-built to your specs and fully integrated with your existing system through advanced API, helping you thrive in any environment.

The right partner makes all the difference. With IR, you gain smarter credit and verification solutions, a team that has your back, and a strategy that grows with you.

/Blogs/2026%20Blogs/02-26-TWN%20Indicator/IR_Blog--Income-Qualify-and-The-Work-Number-Report.png)

Mortgage teams don’t just need data. They need certainty early so they can route loans correctly, avoid unnecessary verification steps, and keep...

/Blogs/2026%20Blogs/01-FHFA-Vantange-FICO/IR_Blog-Credit-Score-Modernization%20(2).png)

As the mortgage industry navigates FHFA’s credit score modernization initiative, lenders are facing new questions around model choice, implementation...

As the mortgage industry navigates FHFA’s credit score modernization initiative, lenders are facing new questions around model choice, implementation...

/images/blog%20images/Verification_Platform_Blog.png)